Insights into the USD/CHF Exchange Rate Dynamics

Insights into the USD/CHF Exchange Rate Dynamics

Quick Look

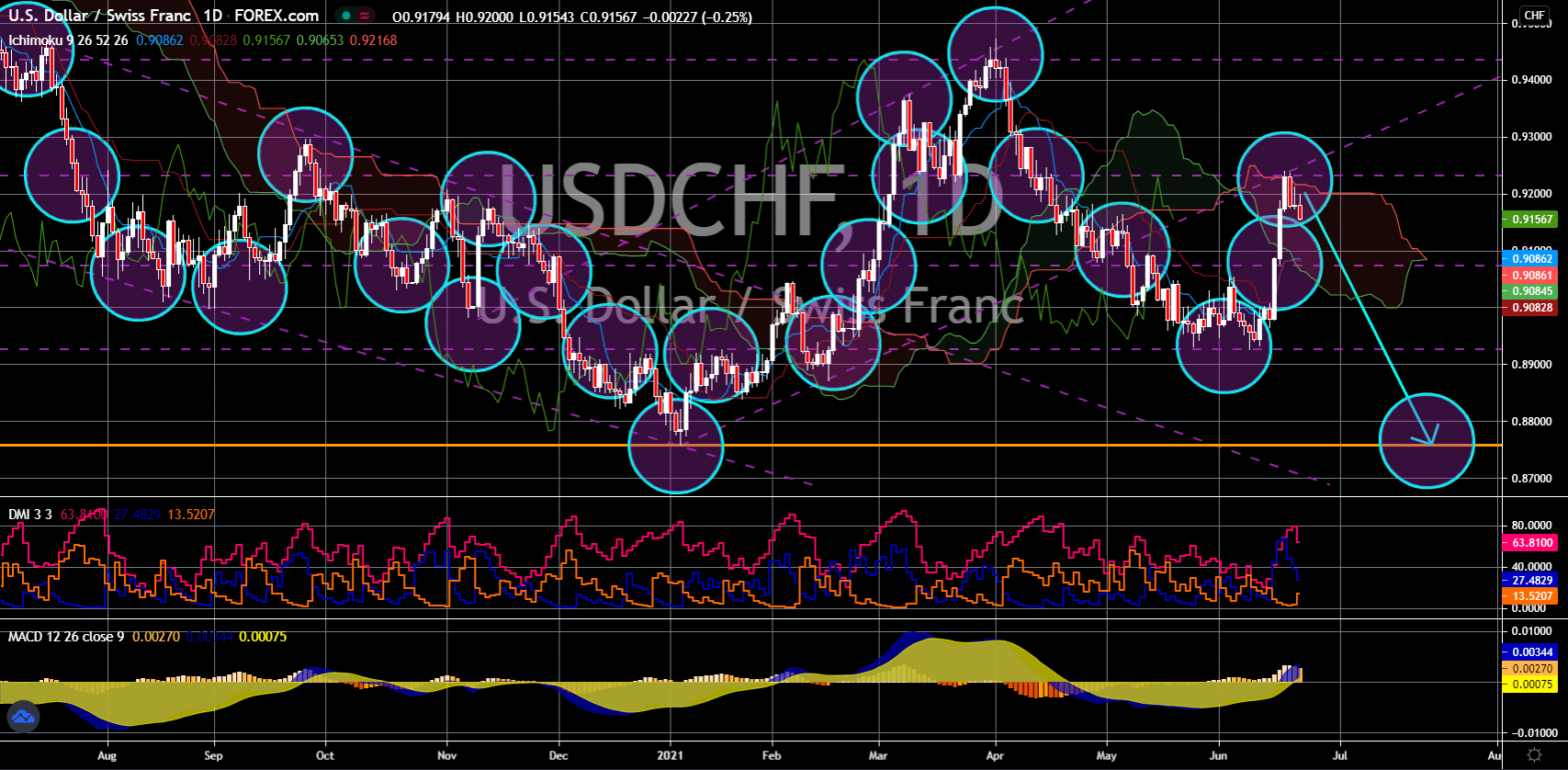

USD/CHF shows mild negative bias, trading around $0.9015, reflecting economic trends. Technical analysis suggests a possible ascent with $0.8728 as key support and $0.9243 as resistance. Upcoming US ISM Manufacturing PMI and Swiss CPI data should influence currency dynamics. February inflation data suggests a cautious Fed stance on rate cuts, with three anticipated in 2023.The financial markets, with their intricate mechanisms and myriad indicators, often resemble a labyrinth for the uninitiated. However, certain signposts can illuminate the path ahead for those who know where to look. Specifically, the USD/CHF currency pair, often considered a barometer of economic stability and investor sentiment, serves as one such signpost. Currently trading with a mild negative bias around $0.9015 in the early European session on Monday, the pair offers a glimpse into the ongoing economic narratives in the United States and Switzerland.

Analysing the USD/CHF Technical Landscape

The journey of the USD/CHF pair, from its medium-term bottom at $0.8332 to the present, mirrors the broader economic trends and central bank policies influencing both currencies. This movement is tentatively seen as developing into a corrective pattern to the downtrend from the 1.0146 peak in 2022. As long as the $0.8728 support holds, further ascent seems plausible. However, any upward momentum is expected to encounter a ceiling at the $0.9243 resistance mark, at least on the initial attempt.

Market participants are now directing their gaze towards the US March ISM Manufacturing Purchasing Managers Index (PMI), anticipated later on Monday. With Switzerland observing the Easter Monday bank holiday, trading volumes may be thinner, setting the stage for a subdued market response to the data release.

Inflation and Central Bank Policies: A Balancing Act

February’s inflation data, aligning with market anticipations, suggests a cautious stance by the Federal Reserve (Fed) before it considers reducing interest rates this year. Market expectations, echoing the Fed’s projections, anticipate three rate cuts, as inferred from the CME Group’s FedWatch Tool.

The Personal Consumption Expenditures Price Index (PCE) – the Fed’s preferred gauge of inflation – recorded a 2.8% year-on-year increase in February. A figure that matched market forecasts, indicating a potential pause in the Fed’s tightening cycle.

On the Swiss front, the Swiss National Bank (SNB) made a strategic move. They reduced the benchmark interest rate by 25 basis points to 1.5% on March 21. This decision was fueled by successful inflation containment over the past two and a half years. Consequently, it paves the way for potential additional rate cuts. Furthermore, the anticipation of softer Swiss Consumer Price Index (CPI) figures for March could further influence the currency dynamics. This might potentially exert downward pressure on the Swiss Franc (CHF).

Future Prospects: Watching the Economic Indicators

As we navigate through these economic indicators, the interplay between inflation data, central bank policies, and market expectations becomes evident. For investors and analysts alike, understanding these dynamics is crucial in forecasting the future direction of the USD/CHF exchange rate. The upcoming Swiss CPI data, along with the US ISM Manufacturing PMI, will provide further clarity, potentially shaping the short to medium-term outlook for these currencies.

The USD/CHF pair, amidst these evolving narratives, remains a critical gauge of economic health and investor confidence, offering valuable insights into the complex dance of global finance.

The post Insights into the USD/CHF Exchange Rate Dynamics appeared first on FinanceBrokerage.